Enterprise value (EV) is a measure of the total value of a company, taking into account its debt and cash. It is calculated as follows:

- Market capitalization: The market capitalization of a company is calculated by multiplying the number of shares outstanding by the current share price. The number of shares outstanding can be found on the company’s financial statements. The current share price can be found on a stock exchange website.

- Debt: The debt of a company is the total amount of money that it owes to its creditors. The debt can be found on the company’s balance sheet.

- Cash: The cash of a company is the amount of money that it has on hand. The cash can be found on the company’s balance sheet under the head ‘current assets.’

Enterprise Value is often used as a measure of a company’s attractiveness to potential buyers. A higher EV indicates that a company is more expensive to acquire. But it also indicates that the company has more assets and/or is generating more cash flow.

EV can be used in a variety of ways, including:

- Comparing the value of companies with different levels of debt: The EV can be used to compare the value of companies that have different levels of debt. This is because EV takes debt into account, while market capitalization does not. For example, two companies with the same market capitalization could have very different enterprise values, if one company has a lot of debt and the other company does not.

- Valuing a company for acquisition or merger: EV can be used to value a company for acquisition or merger. This is because EV takes into account the company’s debt, cash, and future growth potential.

Suppose I want to sell my Company A.

For a layman, the cost that one should pay to buy all shares of Company A is equal to its market capitalization. Suppose the market capitalization of my Company A is Rs.30,000 Crore. To take over the company, one should pay me Rs 30,000 crore and take control of A.

But this will be a mistake of the Buyer. I will gain, but the buyer may lose this way. How? Because, further to Rs.30,000 Crore payment, the buyer may still incur more costs related to A’s 100% acquisition.

Suppose at the time of sale, my Company A was carrying a debt of Rs 1,000 Crore. After the takeover of A, these Rs 1,000 Crore will become the buyer’s liability. So, even though he has already paid Rs 30,000 Crore, he will further need to pay Rs 1,000 Crore to the lenders of “A”.

In this case, the cost of the buyer will increase (Rs 30,000+1,000=Rs 31,000 Crore). Had the buyer paid only Rs.29,000 Crore to me, considering “A” has a debt of Rs.1,000 crore, it would have been the true valuation of the company.

The total effective cost to the buyer will be Rs.30,000 (29,000 paid to the present owner + Rs.1,000 paid to lenders). This is important. Upfront, the buyer must pay only Rs.29,000 crore to the present owner of “A”. From where comes this realization that one must also consider debt levels while calculating true value? By looking at the components of the Enterprise Value Formula.

Now, with this formal understanding of the Enterprise Value in place, let’s try to understand it through the lens of Quantum Physics.

Let’s draw a parallel between the principles of quantum superposition and the diverse components of Enterprise Value.

- Quantum Superposition: As per it, particles can be in two places at once. It helps us understand how the universe works at the very smallest level. For example, an electron can be in two places at once, or it can be both a wave and a particle simultaneously. This is because quantum particles don’t behave like the objects we’re used to in our everyday lives. They follow different rules, and one of those rules is that they can be in multiple states at once.

Taking reference from our knowledge of a quantum particle, that can exist in multiple states, we try to learn about a company’s valuation. We will explore how different aspects of a company’s value, such as market capitalization, debt, and cash, can coexist in a quantum-like superposition.

We will delve into the interplay between these elements and discuss the implications of valuing complex business entities.

Like quantum mechanics is complicated and counterintuitive, valuing a company is also complex. Hence, as an investor, we must do the analysis with a more open perspective.

Imagine a company called Quantum Enterprises. Just like particles in quantum physics, Quantum Enterprises can exist in multiple states simultaneously when it comes to its valuation. Each state represents a different aspect of the company’s value, such as market capitalization, debt, and cash. This simultaneous existence of various valuation components is what we refer to as quantum superposition in the context of Enterprise Value.

The company (Quantum Enterprises) has a market capitalization of Rs. 8000 Crore, a debt of Rs. 4000 Crore, and cash reserves of Rs. 1600 Crore. In classical finance, we would typically consider market capitalization alone to determine the company’s value. However, in the quantum perspective of Enterprise Value, we take into account all the components simultaneously.

The formula of enterprise value looks like this:

In this case, the valuation of Quantum Enterprises would be in a state of quantum superposition. Here, it is both, a Rs. 8000 Crore company (market cap) and a Rs.10400 Crore company (enterprise value).

Why is this important? Quantum superposition in valuation allows us to consider a more comprehensive picture of a company’s value. By acknowledging the coexistence of different components, we gain insights into the financial health, stability, and growth potential of the company (Quantum Enterprises).

Now, let’s think about the implications of quantum superposition in valuation. Suppose Quantum Enterprises has a high market capitalization, indicating strong investor confidence and a positive perception of the market. However, if we solely rely on market capitalization and ignore the debt and cash components, we may overlook important factors that can significantly impact the company’s true value.

By considering all the components simultaneously, we recognize the influence of debt and cash on the company’s intrinsic value. If Quantum Enterprises has a substantial debt burden, it might indicate a higher risk. Similarly, the cash component can enhance the company’s value, as it provides liquidity and financial flexibility for growth opportunities, acquisitions, or debt reduction.

Quantum superposition in valuation broadens our perspective by encompassing all the relevant components simultaneously. It helps us avoid oversimplification and provides a more comprehensive understanding of a company’s true worth.

By recognizing the multiple states of Enterprise Value, we can make better-informed investment decisions. It will give us deeper insights into the financial health and prospects of a company like Quantum Enterprises.

Quantum entanglement, famously referred to as “spooky action at a distance” by Einstein, offers a fascinating perspective on the interconnectedness of particles. We will explore how this concept can be applied to the dynamic relationship between a company’s Enterprise Value and the broader market.

By considering the entanglement between a company’s valuation and market trends, we can gain deeper insights. There is an intricate dance of supply and demand, investor sentiment, and economic forces that shape the enterprise Value. The correlation between quantum entanglement and market dynamics will give us insights.

- Quantum Entanglement: In the world of quantum physics, it is a fascinating phenomenon. It refers to the interconnectedness of particles, even when they are physically separated. Similarly, in the context of Enterprise Value and market dynamics, we can explore how companies’ valuations become entangled with the broader market trends and forces.

To understand this concept, let’s use an analogy:

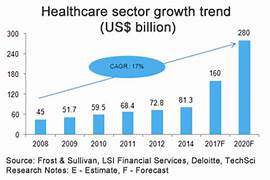

Imagine you have two companies, Company A and Company B. Company A operates in the technology sector, while Company B is in the healthcare industry. Now, let’s assume that the overall market sentiment towards the technology sector is positive, leading to an increase in the valuations of technology companies. At the same time, the healthcare sector faces some challenges, resulting in a decrease in the valuations of healthcare companies.

In this scenario, the valuations of Company A and Company B become entangled with the broader market dynamics. Even though they are separate entities, their values are influenced by the market sentiment toward their respective sectors.

Now, let’s connect this concept to Enterprise Value:

The Enterprise Value of a company, like Company A or Company B, can be entangled with the overall market trends and forces. For instance, suppose, the technology sector experiences a boom and investors have high expectations for technology companies. In this case, the Enterprise Value of Company A might increase as its market cap will rise. On the other hand, if the healthcare sector faces regulatory challenges or unfavorable market conditions, the Enterprise Value of Company B might decrease.

This entanglement between a company’s valuation and market dynamics is crucial to understand as it provides insights into the complex relationship between a company and its market environment.

Understanding the entanglement between Enterprise Value and market dynamics helps investors and analysts make more informed decisions. A company’s value is not solely determined by its internal factors but also intertwined with the broader market sentiment. If investors can realize it, a better assessment of the potential risks and opportunities associated with investing in a particular company can be made.

In summary, quantum entanglement in market dynamics emphasizes the interconnected nature of a company’s valuation with broader market trends and forces. By considering this entanglement, investors can gain a deeper understanding of how market dynamics influence the Enterprise Value of a company. It reminds us that a company’s worth is not isolated but entangled within the intricate dance of supply and demand, investor sentiment, and economic factors that shape the overall market dynamics.

In the context of Enterprise Value and risk assessment, we can draw a parallel. This way we’ll understand how companies with high Enterprise Value can exhibit resilience and navigate through challenging economic conditions.

To understand this concept, let’s use an analogy.

Imagine you have two companies, Company X and Company Y, operating in the same industry. Both companies face an economic downturn that negatively impacts their revenues and profitability. However, Company X has a significantly higher Enterprise Value compared to Company Y.

Now, let’s explore how quantum tunneling relates to these companies:

Quantum tunneling suggests that, despite facing barriers or challenges, certain particles can pass through them. Similarly, in the world of business and finance, a company with a high Enterprise Value, like Company X, may possess the ability to “tunnel” through obstacles and navigate the downturn more effectively compared to a company with a lower Enterprise Value, like Company Y.

Here’s why this is important for risk assessment:

A company with a high Enterprise Value often indicates that it has built a strong foundation, such as a solid customer base, strong brand recognition, or strategic assets. These factors provide a level of resilience that allows the company to weather economic storms more effectively. In other words, just as particles can tunnel through barriers, companies with high Enterprise Value can overcome challenges and maintain their value even in adverse circumstances.

Quantum tunneling in risk assessment suggests that companies with high Enterprise Value can exhibit resilience and navigate through challenging economic conditions more effectively. By considering the tunneling potential of a company, investors and analysts can gain insights into its capacity to withstand volatility and maintain its value, even in adverse circumstances.

Quantum tunneling also reminds us that a company’s Enterprise Value is not solely determined by external economic conditions but also by its internal strength and ability to overcome barriers and challenges.

EV is a valuable metric that can be used to compare the value of companies and the value of a company for acquisition or merger. However, it is important to be aware of the limitations of Enterprise Value (EV) and to use it in conjunction with other metrics when making investment decisions.

How the knowledge of the enterprise value is useful for an investor? To buy a company, an investor would like to pay only the share price to acquire the shares of the company. But if a company also has cash in its balance sheet, the investor would happily pay for it as well.

So, the cost of acquisition increases because of the cash component.

Cost of Acquisition = Market Cap + Cash

If the company also has debt in the company’s balance sheet, the investor would seek a discount from the seller on account of the debt.

Now, the cost of acquisition will decrease because of debt.

Cost of Acquisition = [Market Cap + Cash] – Debt

As market capitalization, debt, and cash are the components of the Enterprise Value, a purposeful study of these components will highlight the fair cost of the acquisition of a company.

I hope you’ve enjoyed reading this out-of-the-box explanation of the enterprise value.

[contact-form][contact-field label=”Name” type=”name” required=”true” /][contact-field label=”Email” type=”email” required=”true” /][contact-field label=”Website” type=”url” /][contact-field label=”Message” type=”textarea” /][/contact-form]