How To Select Option Chain || ATM, OTM, ITM Values || Option Chain ||

HOW TO SELECT OPTION CHAIN ?

Selecting an option chain involves choosing specific options contracts from the available list based on your trading or investment strategy. Option chains display a range of strike prices and expiration dates for a particular underlying asset. Here’s a step-by-step guide on how to select an option chain:

- Underlying Asset Selection: Decide which underlying asset you want to trade options on. This could be stocks, ETFs, indices, or commodities.

- Choose a Trading Platform: Use a reliable trading platform or broker that provides access to option chains. Ensure the platform offers real-time data and a user-friendly interface for analyzing option contracts.

- Access Option Chains: Once logged in, navigate to the section where you can access the option chain for the chosen underlying asset. This is usually found under the “Options” or “Derivatives” section.

- Select Expiration Date: Option chains are organized by expiration dates. Choose the expiration date that aligns with your trading strategy. Short-term traders might choose near-term expirations, while longer-term investors might opt for contracts further out.

- Review Strike Prices: The option chain will display a list of strike prices for the selected expiration date. Each strike price will have associated call and put options. Choose a strike price that aligns with your trading outlook. In-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM) options have different risk-reward profiles.

- Analyze Premiums: Premiums represent the cost of the options contract. Compare the premiums of call and put options at your chosen strike price. Evaluate how the premiums change across different strike prices to understand market sentiment.

- Check Bid-Ask Spreads: The bid price is what buyers are willing to pay, and the ask price is what sellers want. A narrower bid-ask spread indicates better liquidity and price efficiency.

- Consider Implied Volatility: Implied volatility reflects the market’s expectation of future price fluctuations. Higher implied volatility leads to higher option premiums. Factor in implied volatility when selecting options, especially if you have a volatility-based strategy.

- Define Strategy: Determine your options trading strategy: Are you buying options to speculate or selling options to generate income? Different strategies (covered calls, protective puts, straddles, etc.) require different option selections.

- Risk Management: Every trade involves risk. Calculate your potential risk and reward for the selected option contract. Ensure that the trade aligns with your risk tolerance and overall portfolio strategy.

- Place the Trade: Once you’ve selected the option contract that fits your strategy, place the trade through your trading platform. Review your order details carefully before confirming.

- Monitor and Adjust: After entering the trade, monitor your position regularly. Be prepared to adjust your strategy if market conditions change.

Remember that options trading involves substantial risk and is not suitable for all investors. It’s crucial to educate yourself thoroughly about options and understand the associated risks before engaging in trading activities. ATM,OTM,ITM If you’re new to options, consider seeking advice from a financial advisor or experienced trader.

Follow On Youtube :- @tradewithakanksha

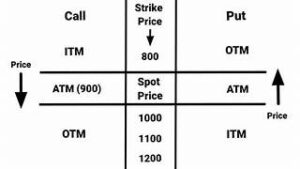

“ATM,” “ITM,” and “OTM” are terms commonly used in options trading to describe the relationship between the strike price of an option and the current market price of the underlying asset. These terms help traders understand the position of an option and its potential profitability. Let’s break down each term:

- ATM (At-The-Money): An option is considered “at-the-money” when the strike price of the option is approximately equal to the current market price of the underlying asset. In other words, there is no intrinsic value in the option. Both call and put options that are at-the-money tend to have premiums that consist mostly of extrinsic value (time value and volatility value). Traders often use at-the-money options for strategies that are more neutral in outlook, as they are less biased towards bullish or bearish movements.

- ITM (In-The-Money): An option is “in-the-money” when it has intrinsic value. For a call option, it’s in-the-money when the strike price is below the current market price of the underlying asset. For a put option, it’s in-the-money when the strike price is above the current market price. In-the-money options tend to have higher premiums compared to at-the-money or out-of-the-money options due to their intrinsic value. Traders often use in-the-money options when they have a strong directional bias and are looking for larger price movements.

- OTM (Out-Of-The-Money): An option is “out-of-the-money” when it has no intrinsic value. For a call option, it’s out-of-the-money when the strike price is above the current market price. For a put option, it’s out-of-the-money when the strike price is below the current market price. Out-of-the-money options have lower premiums compared to at-the-money or in-the-money options, as they only consist of extrinsic value. Traders might use out-of-the-money options for strategies that involve smaller price movements or when they expect the market to stay relatively stable.

In summary:

- ATM (At-The-Money): Strike price ≈ Current market price

- ITM (In-The-Money): Strike price < Current market price (for calls), Strike price > Current market price (for puts)

- OTM (Out-Of-The-Money): Strike price > Current market price (for calls), Strike price < Current market price (for puts)

Keep in mind that the choice between ATM, ITM, and OTM options depends on your trading strategy, market outlook, and risk tolerance. ATM ,OTM, ITM Each type of option has its own advantages and disadvantages, and understanding these terms can help you make more informed decisions when trading options.

An option chain is a representation of all the available ATM,OTM,ITM options contracts for a particular underlying asset, organized by expiration date and strike price. It provides traders and investors with a comprehensive view of the options market for that asset, allowing them to analyze and make informed decisions about their options trading strategies. Here’s how an option chain typically looks and what information it provides:

- Underlying Asset: The option chain will display the name or ticker symbol of the underlying asset, such as a stock, ETF, index, or commodity.

- Expiration Dates: The option chain lists various expiration dates for the options contracts. These dates indicate when the options will expire and become worthless if not exercised. Different expiration dates cater to various trading strategies and timeframes.

- Strike Prices: For each expiration date, the option chain displays a range of strike prices. These are the predetermined prices at which an option can be exercised. Strike prices are categorized into in-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM) based on their relationship to the current market price of the underlying asset.

- Call Options: The option chain shows call options on the left side. For each strike price and expiration date, you’ll find information such as the bid price, ask price, last trade price, volume, and open interest. The bid price is what buyers are willing to pay, while the ask price is what sellers are asking for. Volume indicates the number of contracts traded, and open interest shows the total number of outstanding contracts.

- Put Options: The right side of the option chain displays put options. Similar to call options, you’ll find bid, ask, last trade price, volume, and open interest information for put options corresponding to various strike prices and expiration dates.

- Implied Volatility: Some option chains also include the implied volatility for each option contract. Implied volatility reflects the market’s expectation of future price fluctuations for the underlying asset. It can influence the premium of an option.

- Open Interest: Open interest represents the total number of outstanding contracts for a particular option. High open interest suggests active trading and liquidity in that option contract.

- Volume: Volume indicates how many contracts of a particular option have been traded during a specific time period. High volume can signify increased interest and activity in that option.

- Bid-Ask Spread: The difference between the bid and ask prices is known as the bid-ask spread. A narrow spread indicates good liquidity, while a wide spread might suggest lower liquidity and potentially higher trading costs.

Using an option chain, traders can compare different strike prices and expiration dates, evaluate premiums, assess market sentiment, and tailor their options strategies to their market outlook and risk tolerance. It’s important to understand the information presented in the ATM, OTM, ITM option chain and how it aligns with your trading goals before making any trading decisions.

It sounds like you’re interested in becoming an option trader. Option trading involves buying and selling options contracts on various underlying assets such as stocks, ETFs, commodities, or indices. Option trading can offer opportunities to profit from price movements, volatility, and market trends. ATM,OTM,ITM However, it’s important to note that options trading carries a certain level of risk and requires a good understanding of the market, strategies, and risk management. Here’s a general overview of how to become an option trader:

- Education: Start by learning the basics of options trading. Understand the terminology, concepts like call and put options, and the factors that influence option prices, such as volatility, time decay, and underlying asset movement. There are numerous online resources, courses, books, and trading platforms that offer educational content.

- Market Analysis: Develop a solid understanding of technical and fundamental analysis. This will help you make informed decisions about which options to trade, based on your market outlook and strategy.

- Choose a Trading Platform: Select a brokerage platform that offers options trading. Ensure the platform provides the tools and resources you need to research, analyze, and execute options trades.

- Practice: Consider starting with a virtual trading account or paper trading to practice your strategies without risking real money. This can help you gain experience and build confidence.

- Develop a Strategy: Determine your preferred options trading strategy. There are various strategies like covered calls, protective puts, straddles, spreads, and more. Each strategy has its own risk and reward profile, so choose one that aligns with your goals and risk tolerance.

- Risk Management: Establish risk management rules. Determine how much capital you’re willing to allocate to options trading and how much of that you’re willing to risk on a single trade. Set stop-loss orders to limit potential losses.

- Stay Informed: Continuously keep up with market news, economic indicators, earnings reports, and events that could impact the assets you’re trading.

- Start Small: Begin with a small position size until you become more comfortable and experienced in options trading. This helps you manage risk while learning the ropes.

- Analyze and Adjust: Regularly review your trades and analyze what worked and what didn’t. Adjust your strategies based on your experiences and market conditions.

- Seek Professional Guidance: If needed, consider consulting with financial advisors or professionals who specialize in options trading for personalized advice.

- Emotional Control: Options trading can be emotional, especially during periods of high volatility. Develop the emotional discipline to stick to your trading plan and not make impulsive decisions.

Remember that options trading can be complex, and it’s important to take your time to learn, practice, and gradually increase your involvement as you gain experience. ATM,OTM,ITM Be prepared for both successes and setbacks as you navigate the world of options trading.

Deciding on options buying involves considering various factors to make informed choices that align with your trading goals and risk tolerance. ATM,OTM,ITM Here’s a step-by-step guide to help you make decisions when buying options:

- Underlying Asset Analysis:

- Start by analyzing the underlying asset (usually a stock) that the options are based on. Understand the company’s financials, industry trends, news, and potential for price movement.

- Market Outlook:

- Formulate a clear view of the market’s direction. Are you bullish (expecting prices to rise), bearish (expecting prices to fall), or neutral?

- Expiration Date:

- Choose an expiration date that aligns with your market outlook and trading strategy. Short-term options (near-term expirations) are riskier but can offer quicker profits, while long-term options provide more time for your thesis to play out.

- Strike Price Selection:

- Depending on your market outlook, choose the appropriate strike price. If you’re bullish, consider slightly out-of-the-money or at-the-money calls. If you’re bearish, consider slightly out-of-the-money or at-the-money puts.

- Option Type:

- Decide whether to buy call options (betting on price increase) or put options (betting on price decrease) based on your market outlook.

- Risk Tolerance:

- Determine how much risk you’re comfortable with. Options trading can be highly leveraged and speculative, so only invest what you can afford to lose.

- Volatility Consideration:

- High volatility can increase option prices. If you expect significant price swings, it might be a good time to buy options. Conversely, if volatility is low, options may be cheaper but may require larger price movements to become profitable.

- Time Decay (Theta):

- Options lose value over time due to time decay. Factor in the rate of time decay when choosing an expiration date.

- Position Sizing:

- Determine the appropriate amount of capital to allocate to options trading. Avoid concentrating too much of your portfolio in a single trade.

- Diversification:

- Diversify your options positions across different assets, industries, and strategies to manage risk.

- Exit Strategy:

- Plan your exit strategy before entering the trade. Decide at what point you’ll take profits or cut losses. Stick to your plan to avoid emotional decision-making.

- Stay Informed:

- Keep up with market news, earnings reports, and relevant events that could impact your options positions.

- Practice and Education:

- If you’re new to options trading, consider starting with a virtual trading account to practice without risking real money. Educate yourself about options trading strategies, Greeks (like delta, gamma, etc.), and risk management.

- Consult Professionals:

- If needed, consult financial advisors or professionals who specialize in options trading for personalized guidance.

Remember that options trading involves substantial risk and is not suitable for all investors. ATM, OTM, ITM It’s important to do thorough research, understand the strategies you’re using, and be prepared for both potential gains and losses.

[contact-form][contact-field label=”Name” type=”name” required=”true” /][contact-field label=”Email” type=”email” required=”true” /][contact-field label=”Website” type=”url” /][contact-field label=”Message” type=”textarea” /][/contact-form]