Intraday 98% Daily Accurate Calls Never Loss Again In Stock Market

Intraday 98% Daily Accurate Calls Never Loss

Follow On Youtube :- @tradewithakanksha

Intraday 98% Daily Accurate Calls Never Loss Again In Stock Market Certainly, intraday trading refers to a trading strategy in which market participants buy and sell financial instruments, such as stocks, within the same trading day. Intraday traders aim to profit from short-term price movements, taking advantage of price fluctuations that occur within the span of a single trading session. Positions are typically closed before the market closes for the day, which means intraday traders do not hold their positions overnight.

Here are some key characteristics and considerations of intraday trading:

- Timeframe: Intraday trading focuses on short-term timeframes, ranging from a few minutes to a few hours. Traders aim to capitalize on price movements that occur during the trading day.

- Liquidity: Intraday traders often focus on highly liquid assets, such as actively traded stocks or major currency pairs. High liquidity helps ensure that traders can enter and exit positions without significant price slippage.

- Risk Management: Since intraday trading involves quick trades and short holding periods, risk management is crucial. Traders often set stop-loss orders to limit potential losses and determine position sizes based on their risk tolerance.

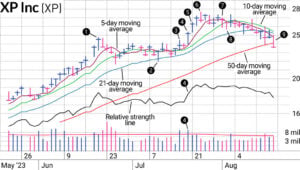

- Technical Analysis: Many intraday traders rely on technical analysis to identify patterns, trends, and potential entry and exit points. Technical indicators, chart patterns, and price action analysis are commonly used tools.

- Volatility: Intraday traders often seek markets or securities with sufficient volatility, as larger price movements offer more trading opportunities. However, higher volatility also brings increased risk.

- Market Monitoring: Intraday traders need to monitor the market closely throughout the trading day. They may use real-time data feeds, trading platforms, and news sources to stay informed about market developments.

- Psychology: Intraday trading requires discipline and emotional control. Quick decisions and rapid price changes can lead to emotional reactions, so traders must manage their psychology effectively.

- Costs: Frequent trading can lead to higher transaction costs due to commissions and fees associated with each trade. Traders should factor in these costs when determining their profit targets.

- Pattern Day Trading Rules: In the United States, the SEC has established rules for pattern day traders who execute more than three day trades within a rolling five-day period. These rules require traders to maintain a minimum account balance.

Intraday 98% Daily Accurate Calls Never Loss Again In Stock Market It’s important to note that intraday trading can be highly rewarding but also carries substantial risks. Success requires a deep understanding of the markets, trading strategies, risk management techniques, and the ability to adapt to rapidly changing conditions. Many traders opt for a combination of intraday and longer-term strategies to diversify their trading approaches and manage risk.

“Swing calls” generally refer to trading or investment recommendations, often provided by analysts or experts, suggesting potential buy or sell opportunities in the stock market. The term “swing” indicates a shorter time frame than long-term investing, but longer than intraday trading. Swing trading involves holding positions for several days or weeks, aiming to capture price movements within a trend.

Here are some key points about swing calls and swing trading:

- Swing Calls: A “swing call” is a recommendation or suggestion made by market analysts or experts regarding specific stocks or assets that are expected to experience price swings or movements. These calls provide insights on potential entry and exit points for traders or investors interested in capturing short-to-medium-term price changes.

- Trend-Based: Swing trading is often based on identifying and capitalizing on trends. Traders aim to enter positions when they expect a price trend to begin and exit when the trend is expected to reverse.

- Technical Analysis: Swing traders frequently use technical analysis tools, such as chart patterns, technical indicators, and support/resistance levels, to make trading decisions and determine entry and exit points.

- Position Holding: Unlike intraday trading, swing traders hold positions for more than a single trading session. The holding period can range from a few days to a few weeks.

- Risk Management: Risk management remains crucial in swing trading. Traders use stop-loss orders to limit potential losses and position sizing techniques to manage risk.

- Volatility: Swing traders often seek assets with moderate volatility, as significant price movements within a short time frame can offer profit opportunities.

- Market Analysis: Market news, economic data releases, and geopolitical events can influence swing trades. Traders may adjust their positions based on these external factors.

- Psychological Aspects: Like any form of trading, swing trading requires emotional discipline and control. Traders need to manage psychological responses to price fluctuations.

- Costs and Fees: Trading costs, including commissions and fees, need to be factored into swing trading strategies to ensure they don’t erode potential profits.

Intraday 98% Daily Accurate Calls Never Loss Again In Stock Market It’s important to note that while swing trading can offer a balance between the shorter-term nature of intraday trading and the longer-term focus of traditional investing, it still carries risks. Successful swing trading requires a combination of technical and fundamental analysis skills, a robust trading plan, effective risk management, and an understanding of the specific dynamics of the assets being traded. As with any trading or investment approach, proper education and practice are essential.

Intraday 98% Daily Accurate Calls Never Loss Again In Stock Market

Providing accurate intraday trading calls involves a deep understanding of the market, analysis, and a solid trading strategy. However, it’s important to note that no trading strategy or service can guarantee 100% accuracy, as the stock market involves inherent risks and uncertainties. If you’re seeking intraday trading calls, here are some steps to consider:

- Education: Before following any trading calls, educate yourself about the stock market, different trading strategies, technical and fundamental analysis, and risk management.

- Research: Choose reliable sources for trading calls. Look for reputable financial news websites, professional traders, or analysts who provide insights backed by data and analysis.

- Technical Analysis: Many intraday traders rely on technical analysis, using indicators, chart patterns, and price action to make trading decisions. Familiarize yourself with these tools and how they can help identify potential entry and exit points.

- Risk Management: This is crucial. Only invest or trade with money you can afford to lose. Set stop-loss orders to limit potential losses on each trade.

- Paper Trading: Practice your trading strategy without real money using a paper trading platform. This helps you gain confidence and refine your strategy without risking capital.

- Consistency: Stick to a consistent strategy. Avoid making impulsive decisions based on emotions or short-term fluctuations.

- Demo Accounts: Many brokers offer demo accounts that allow you to practice trading in real market conditions without real money. This can help you test your strategy.

- Start Small: Begin with a small trading capital and gradually increase it as you gain experience and confidence.

- Trading Plan: Create a detailed trading plan that outlines your strategy, risk tolerance, entry and exit criteria, and more.

- Track Records: Keep a record of your trades, including reasons for entry and exit, profit or loss, and lessons learned.

- Avoid Overtrading: Overtrading can lead to emotional decisions and increased transaction costs. Stick to your plan and avoid excessive trading.

- Stay Informed: Be aware of economic events, earnings reports, and other news that might impact the stocks you’re trading.

Remember that no trading strategy can guarantee profits, and losses are a natural part of trading. It’s important to approach intraday trading with caution, patience, and a willingness to learn from both successes and failures. If you’re new to trading, consider seeking guidance from experienced traders or professionals before making trading decisions.

Providing accurate intraday trading calls involves a deep understanding of the market, analysis, and a solid trading strategy. However, it’s important to note that no trading strategy or service can guarantee 100% accuracy, as the stock market involves inherent risks and uncertainties. If you’re seeking intraday trading calls, here are some steps to consider:

- Education: Before following any trading calls, educate yourself about the stock market, different trading strategies, technical and fundamental analysis, and risk management.

- Research: Choose reliable sources for trading calls. Look for reputable financial news websites, professional traders, or analysts who provide insights backed by data and analysis.

- Technical Analysis: Many intraday traders rely on technical analysis, using indicators, chart patterns, and price action to make trading decisions. Familiarize yourself with these tools and how they can help identify potential entry and exit points.

- Risk Management: This is crucial. Only invest or trade with money you can afford to lose. Set stop-loss orders to limit potential losses on each trade.

- Paper Trading: Practice your trading strategy without real money using a paper trading platform. This helps you gain confidence and refine your strategy without risking capital.

- Consistency: Stick to a consistent strategy. Avoid making impulsive decisions based on emotions or short-term fluctuations.

- Demo Accounts: Many brokers offer demo accounts that allow you to practice trading in real market conditions without real money. This can help you test your strategy.

- Start Small: Begin with a small trading capital and gradually increase it as you gain experience and confidence.

- Trading Plan: Create a detailed trading plan that outlines your strategy, risk tolerance, entry and exit criteria, and more.

- Track Records: Keep a record of your trades, including reasons for entry and exit, profit or loss, and lessons learned.

- Avoid Overtrading: Overtrading can lead to emotional decisions and increased transaction costs. Stick to your plan and avoid excessive trading.

- Stay Informed: Be aware of economic events, earnings reports, and other news that might impact the stocks you’re trading.

Intraday 98% Daily Accurate Calls Never Loss Again In Stock Market Remember that no trading strategy can guarantee profits, and losses are a natural part of trading. It’s important to approach intraday trading with caution, patience, and a willingness to learn from both successes and failures. If you’re new to trading, consider seeking guidance from experienced traders or professionals before making trading decisions.

Providing accurate intraday trading calls involves a deep understanding of the market, analysis, and a solid trading strategy. However, it’s important to note that no trading strategy or service can guarantee 100% accuracy, as the stock market involves inherent risks and uncertainties. If you’re seeking intraday trading calls, here are some steps to consider: Intraday 98% Daily Accurate Calls Never Loss Again In Stock Market

- Education: Before following any trading calls, educate yourself about the stock market, different trading strategies, technical and fundamental analysis, and risk management.

- Research: Choose reliable sources for trading calls. Look for reputable financial news websites, professional traders, or analysts who provide insights backed by data and analysis.

- Technical Analysis: Many intraday traders rely on technical analysis, using indicators, chart patterns, and price action to make trading decisions. Familiarize yourself with these tools and how they can help identify potential entry and exit points.

- Risk Management: This is crucial. Only invest or trade with money you can afford to lose. Set stop-loss orders to limit potential losses on each trade.

- Paper Trading: Practice your trading strategy without real money using a paper trading platform. This helps you gain confidence and refine your strategy without risking capital.

- Consistency: Stick to a consistent strategy. Avoid making impulsive decisions based on emotions or short-term fluctuations.

- Demo Accounts: Many brokers offer demo accounts that allow you to practice trading in real market conditions without real money. This can help you test your strategy.

- Start Small: Begin with a small trading capital and gradually increase it as you gain experience and confidence.

- Trading Plan: Create a detailed trading plan that outlines your strategy, risk tolerance, entry and exit criteria, and more.

- Track Records: Keep a record of your trades, including reasons for entry and exit, profit or loss, and lessons learned.

- Avoid Overtrading: Overtrading can lead to emotional decisions and increased transaction costs. Stick to your plan and avoid excessive trading.

- Stay Informed: Be aware of economic events, earnings reports, and other news that might impact the stocks you’re trading.

Intraday 98% Daily Accurate Calls Never Loss Again In Stock Market Remember that no trading strategy can guarantee profits, and losses are a natural part of trading. It’s important to approach intraday trading with caution, patience, and a willingness to learn from both successes and failures. If you’re new to trading, consider seeking guidance from experienced traders or professionals before making trading decisions.

[contact-form][contact-field label=”Name” type=”name” required=”true” /][contact-field label=”Email” type=”email” required=”true” /][contact-field label=”Website” type=”url” /][contact-field label=”Message” type=”textarea” /][/contact-form]