ATM / OTM/ ITM – How To Decide In Options Buying | किसमे सबसे ज्यादा पैसा बनता है | Option Trading

ATM / OTM/ ITM

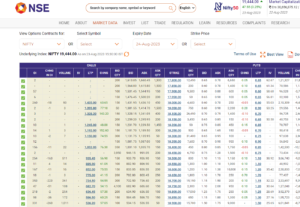

ATM, OTM, and ITM are terms commonly used in options trading to describe the relationship between the current stock price and the strike price of an option. These terms help traders understand whether an option is in a favorable or unfavorable position based on the market conditions. Here’s what each term means:

- ATM (At-The-Money): An option is considered at-the-money when its strike price is approximately equal to the current market price of the underlying asset (usually a stock). In other words, there is no intrinsic value in an at-the-money option. For call options, the strike price is equal to the current market price of the stock, and for put options, the strike price is also equal to the current market price. ATMs are often seen as neutral options, as they have the potential to move either in-the-money or out-of-the-money depending on market movements.

- OTM (Out-of-The-Money): An option is out-of-the-money when its strike price is not favorable based on the current market price of the underlying asset. For call options, an OTM option has a strike price higher than the current market price of the stock. For put options, an OTM option has a strike price lower than the current market price. OTM options have no intrinsic value, and their value is primarily composed of time value. These options need significant market movement to become profitable.

- ITM (In-The-Money): An option is in-the-money when its strike price is favorable based on the current market price of the underlying asset. For call options, an ITM option has a strike price lower than the current market price of the stock. For put options, an ITM option has a strike price higher than the current market price. ITM options have both intrinsic value (the difference between the strike price and the current market price) and time value. They are generally more expensive than OTM options and are more likely to be exercised by the option holder.

In summary, ATM options have strike prices close to the current market price, OTM options have strike prices unfavorable to the current market price, and ITM options have strike prices favorable to the current market price. The position of an option relative to the current market price plays a significant role in its potential profitability and risk.

FOLLOW MY YouTube – https://www.youtube.com/watch?v=TT3WQgjuUEw&t=12s

Deciding on options buying involves considering various factors to make informed choices that align with your trading goals and risk tolerance. Here’s a step-by-step guide to help you make decisions when buying options:

- Underlying Asset Analysis:

- Start by analyzing the underlying asset (usually a stock) that the options are based on. Understand the company’s financials, industry trends, news, and potential for price movement.

- Market Outlook:

- Formulate a clear view of the market’s direction. Are you bullish (expecting prices to rise), bearish (expecting prices to fall), or neutral?

- Expiration Date:

- Choose an expiration date that aligns with your market outlook and trading strategy. Short-term options (near-term expirations) are riskier but can offer quicker profits, while long-term options provide more time for your thesis to play out.

- Strike Price Selection:

- Depending on your market outlook, choose the appropriate strike price. If you’re bullish, consider slightly out-of-the-money or at-the-money calls. If you’re bearish, consider slightly out-of-the-money or at-the-money puts.

- Option Type:

- Decide whether to buy call options (betting on price increase) or put options (betting on price decrease) based on your market outlook.

- Risk Tolerance:

- Determine how much risk you’re comfortable with. Options trading can be highly leveraged and speculative, so only invest what you can afford to lose.

- Volatility Consideration:

- High volatility can increase option prices. If you expect significant price swings, it might be a good time to buy options. Conversely, if volatility is low, options may be cheaper but may require larger price movements to become profitable.

- Time Decay (Theta):

- Options lose value over time due to time decay. Factor in the rate of time decay when choosing an expiration date.

- Position Sizing:

- Determine the appropriate amount of capital to allocate to options trading. Avoid concentrating too much of your portfolio in a single trade.

- Diversification:

- Diversify your options positions across different assets, industries, and strategies to manage risk.

- Exit Strategy:

- Plan your exit strategy before entering the trade. Decide at what point you’ll take profits or cut losses. Stick to your plan to avoid emotional decision-making.

- Stay Informed:

- Keep up with market news, earnings reports, and relevant events that could impact your options positions.

- Practice and Education:

- If you’re new to options trading, consider starting with a virtual trading account to practice without risking real money. Educate yourself about options trading strategies, Greeks (like delta, gamma, etc.), and risk management.

- Consult Professionals:

- If needed, consult financial advisors or professionals who specialize in options trading for personalized guidance.

Remember that options trading involves substantial risk and is not suitable for all investors. It’s important to do thorough research, understand the strategies you’re using, and be prepared for both potential gains and losses.

When looking for potential stocks for options trading, consider the following factors:

- Liquidity: Choose stocks with high trading volume and open interest in their options contracts. This ensures tighter bid-ask spreads and better execution of trades.

- Volatility: Stocks with higher volatility tend to have more significant price movements, which can be advantageous for options traders looking to profit from price swings.

- Earnings and News: Stocks that are about to release earnings or have significant news events can experience increased volatility, presenting potential trading opportunities.

- Trend and Technical Analysis: Analyze the stock’s price trend and technical indicators to identify potential entry and exit points.

- Diversification: Consider a mix of different stocks across various industries to manage risk.

- Company Fundamentals: Research the company’s financial health, growth prospects, and competitive landscape before considering it for options trading.

- Options Strategy: The best stock for options trading depends on the strategy you plan to use—whether it’s covered calls, protective puts, straddles, or others. Different stocks may be better suited for different strategies.

- Risk Management: Always consider your risk tolerance and only trade with capital you can afford to lose.

To find potential stocks for options trading, you can use financial news sources, stock screeners, options trading platforms, and professional advice. It’s essential to do thorough research and potentially consult with a financial advisor before making Options Buying any trading decisions.

It seems like you’re asking about “In-The-Money” (ITM) options. In-The-Money options are options contracts that have intrinsic value due to their favorable relationship to the current market price of the underlying asset. Let’s delve into this concept in more detail:

An option can be either “in-the-money,” “at-the-money,” or “out-of-the-money,” and these terms describe the relationship between the option’s strike price and the current market price of the underlying asset (usually a stock).

In the context of call options:

- An option is In-The-Money (ITM) when its strike price is lower than the current market price of the underlying asset. This means that if you were to exercise the call option, you could buy the asset at a lower price than its current market value.

- Example: If the stock’s current market price is $50, an ITM call option might have a strike price of $40. This gives you the right to buy the stock at $40, which is lower than its current price of $50, thus having intrinsic value.

- An option is At-The-Money (ATM) when its strike price is approximately equal to the current market price of the underlying asset. There is no intrinsic value in an ATM option; its value is primarily time value.

- An option is Out-Of-The-Money (OTM) when its strike price is higher than the current market price of the underlying asset. An OTM option only has time value and no intrinsic value.

In the context of put options, the relationships are reversed:

- An option is In-The-Money (ITM) when its strike price is higher than the current market price of the underlying asset. This means that if you were to exercise the put option, you could sell the asset at a higher price than its current market value.

- An option is At-The-Money (ATM) when its strike price is approximately equal to the current market price of the underlying asset.

- An option is Out-Of-The-Money (OTM) when its strike price is lower than the current market price of the underlying asset.

When considering trading ITM options, you should be aware that they generally have a higher premium compared to out-of-the-money options because of their intrinsic value. ITM options are often used as a way to gain exposure to the underlying asset with less capital compared to buying the asset outright. However, they are also more expensive, and their price movement may not be as dramatic as out-of-the-money options as ATM / OTM/ ITM.

As with all options trading, understanding your strategy, market outlook, and risk tolerance is crucial before making any trading decisions.

It sounds like you’re interested in becoming an option trader. Option trading involves buying and selling options contracts on various underlying assets such as stocks, ETFs, commodities, or indices. Option trading can offer opportunities to profit from price movements, volatility, and market trends. However, it’s important to note that options trading carries a certain level of risk and requires a good understanding of the market, strategies, and risk management. Here’s a general overview of how to become an option trader:

- Education: Start by learning the basics of options trading. Understand the terminology, concepts like call and put options, and the factors that influence option prices, such as volatility, time decay, and underlying asset movement. There are numerous online resources, courses, books, and trading platforms that offer educational content.

- Market Analysis: Develop a solid understanding of technical and fundamental analysis. This will help you make informed decisions about which options to trade, based on your market outlook and strategy.

- Choose a Trading Platform: Select a brokerage platform that offers options trading. Ensure the platform provides the tools and resources you need to research, analyze, and execute options trades.

- Practice: Consider starting with a virtual trading account or paper trading to practice your strategies without risking real money. This can help you gain experience and build confidence.

- Develop a Strategy: Determine your preferred options trading strategy. There are various strategies like covered calls, protective puts, straddles, spreads, and more. Each strategy has its own risk and reward profile, so choose one that aligns with your goals and risk tolerance.

- Risk Management: Establish risk management rules. Determine how much capital you’re willing to allocate to options trading and how much of that you’re willing to risk on a single trade. Set stop-loss orders to limit potential losses.

- Stay Informed: Continuously keep up with market news, economic indicators, earnings reports, and events that could impact the assets you’re trading.

- Start Small: Begin with a small position size until you become more comfortable and experienced in options trading. This helps you manage risk while learning the ropes.

- Analyze and Adjust: Regularly review your trades and analyze what worked and what didn’t. Adjust your strategies based on your experiences and market conditions.

- Seek Professional Guidance: If needed, consider consulting with financial advisors or professionals who specialize in options trading for personalized advice.

- Emotional Control: Options trading can be emotional, especially during periods of high volatility. Develop the emotional discipline to stick to your trading plan and not make impulsive decisions.

Remember that options trading can be complex, and it’s important to take your time to learn, practice, and gradually increase your involvement as you gain experience. Be prepared for both successes and setbacks as you navigate the world of options trading.

Intraday trading, also known as day trading, refers to the practice of buying and selling financial instruments (such as stocks, commodities, forex, or options) within the same trading day. The goal of intraday trading is to profit from short-term price movements in the market. Traders engaged in intraday trading typically close all their positions by the end of the trading day, aiming to capitalize on small price fluctuations.

Here are some key points to consider if you’re interested in intraday trading:

- Short Timeframes: Intraday traders focus on short timeframes, often using minute-by-minute or hourly charts to make trading decisions.

- Volatility: Intraday trading thrives on price volatility. Traders look for assets that exhibit substantial price movements within a single trading session.

- Technical Analysis: Technical analysis is essential for intraday trading. Traders use various technical indicators, chart patterns, and trend analysis to identify potential entry and exit points.

- Risk Management: Because of the quick pace of intraday trading, risk management is crucial. Traders often set strict stop-loss orders to limit potential losses.

- Liquidity: Intraday traders focus on assets with high trading volumes to ensure they can enter and exit positions easily.

- Market Analysis: Traders analyze both market news and technical indicators to identify potential trading opportunities.

- Strategy Selection: There are various intraday trading strategies, such as scalping (profiting from small price movements), momentum trading (trading with the direction of strong price trends), and mean reversion (capitalizing on price reversals).

- Constant Monitoring: Intraday traders need to stay engaged with the market throughout the trading day, as quick decisions are often required.

- Psychological Discipline: The fast-paced nature of intraday trading can be stressful. Emotional control and discipline are vital to avoid making impulsive decisions.

- Education and Practice: Intraday trading requires a solid understanding of the markets, technical analysis, and trading strategies. Practicing on a demo account or with small capital before committing significant funds can help build experience.

- Commissions and Costs: Frequent trading can lead to higher transaction costs due to commissions and fees. It’s important to factor these costs into your strategy.

Intraday trading can be rewarding, but it’s also associated with higher risk due to the short timeframes and potential for rapid price fluctuations. Success in intraday trading depends on Options Buying careful planning, thorough analysis, risk management, and a strong understanding of trading principles.

Option buying is a ATM / OTM/ ITM strategy in options trading where an investor purchases options contracts with the expectation of profiting from price movements in the underlying asset. Options give you the right, but not the obligation, to buy or sell the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). When you buy options, you’re paying a premium to gain this right.

Here are some key points to consider when engaging in option buying:

- Call Options: Buying a call option gives you the right to buy the underlying asset at the strike price. Traders buy call options when they anticipate the underlying asset’s price will rise.

- Put Options: Buying a put option gives you the right to sell the underlying asset at the strike price. Traders buy put options when they expect the underlying asset’s price to decline.

- Cost: Premium: The premium is the price you pay to buy an options contract. It’s the maximum amount you can lose if the option expires worthless. Premiums vary based on factors like the strike price, time until expiration, market volatility, and the current price of the underlying asset.

- Profit Potential and Loss Limit: The potential profit when buying options is theoretically unlimited for call options (if the price of the underlying asset rises significantly) and limited to the strike price minus the premium for put options. The maximum loss is limited to the premium paid for the option.

- Time Decay: Options contracts have a limited lifespan. As the expiration date approaches, the time value of the option decreases. This is known as time decay, and it can impact the option’s value.

- In-The-Money, At-The-Money, Out-Of-The-Money: Consider whether the option is in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM) based on the relationship between the option’s strike price and the current market price of the underlying asset.

- Volatility: Higher volatility can lead to higher option premiums. Traders may buy options when they anticipate increased price volatility.

- Market Analysis: Just like with stocks, conducting thorough market analysis is important before buying options. Understand the underlying asset’s trends, news, and potential catalysts.

- Exit Strategy: Determine your exit strategy before entering the trade. Decide at what point you’ll take profits or cut losses. Stick to your plan to avoid emotional decision-making.

- Risk Management: Only invest what you can afford to lose. Options trading can be speculative and involves risk, so proper risk management is crucial.

- Education and Practice: If you’re new to options trading, it’s wise to educate yourself about different options strategies and practice with virtual trading accounts before using real money in ATM / OTM/ ITM.

Remember that options trading carries risk, and not all options trades will be profitable. It’s important ATM / OTM/ ITM to thoroughly understand options, the market, and your chosen strategy before engaging in option buying.

Certainly, analysis is a critical aspect of trading and investing. It involves studying various factors that influence the market, assets, and potential trades. There are two main types of analysis: fundamental analysis and technical analysis.

- Fundamental Analysis: Fundamental analysis involves evaluating the intrinsic value of an asset, often based on its financial health, industry trends, and broader economic factors. Key elements of fundamental analysis include:

- Earnings Reports: Reviewing a company’s financial statements, earnings, revenue, expenses, and profit margins to assess its financial performance.

- Industry and Market Analysis: Understanding the current state and future prospects of the industry in which the asset operates. Analyzing market trends, demand, and competition.

- Economic Indicators: Monitoring economic indicators like GDP growth, unemployment rates, inflation, and interest rates to gauge the overall economic health and potential impact on investments.

- Management and Governance: Evaluating the quality of a company’s management team and its corporate governance practices.

- News and Events: Keeping up with news, events, and developments that could impact the asset’s value, such as product launches, mergers, regulatory changes, etc.

- Technical Analysis: Technical analysis involves studying historical price and volume data to predict future price movements. It focuses on charts and patterns. Key elements of technical analysis include:

- Price Patterns: Identifying chart patterns like head and shoulders, double tops, and triangles to predict price reversals or continuations.

- Indicators: Using technical indicators like moving averages, Relative Strength Index (RSI), MACD, and Bollinger Bands to assess momentum, trends, and overbought/oversold conditions.

- Support and Resistance: Identifying levels where an asset’s price tends to find support (stops declining) or resistance (stops rising).

- Volume Analysis: Analyzing trading volume to understand the strength of price movements and potential trend changes.

- Trend Analysis: Identifying the prevailing trend (uptrend, downtrend, or sideways) and aligning trades accordingly.

Both fundamental and technical analysis can be used in combination to make more well-rounded trading decisions. However, the approach you choose may depend on your trading style, time horizon, and personal preferences.

Remember that analysis is not a guaranteed predictor of future market movements, and risk is inherent in trading and investing. It’s important to continually educate yourself, stay updated on market news, and practice disciplined risk management to navigate the complexities of the financial markets.

A volatile market refers to a market that experiences significant and rapid price fluctuations over a relatively short period of time. Volatility is a measure of how much the price of an asset, such as a stock, currency pair, or commodity, tends to deviate from its average price over time. High volatility indicates larger price swings, while low volatility suggests smaller price movements.

Here are some key points to understand about a volatile market:

- Causes of Volatility:

- Economic Events: Significant economic releases, such as GDP reports, unemployment numbers, and interest rate decisions, can lead to market volatility.

- Earnings Reports: Earnings announcements by companies can result in sharp price movements.

- Geopolitical Events: Political instability, trade tensions, and other geopolitical factors can create uncertainty and volatility in the markets.

- Market Sentiment: Investor sentiment and emotions can lead to sudden market swings.

- External Shocks: Unexpected events, like natural disasters or health crises (e.g., COVID-19), can trigger market turmoil.

- Impact on Traders:

- Opportunities: Volatile markets can present trading opportunities for those who can accurately predict price movements.

- Risk: However, increased volatility also comes with higher risk, as prices can move quickly in both directions, leading to potential losses.

- Short-Term Focus: Volatile markets often attract short-term traders and day traders seeking to capitalize on rapid price changes.

- Volatility Index (VIX):

- The VIX, often referred to as the “fear index,” measures market volatility and investors’ expectations of future volatility. It’s commonly used to gauge market sentiment.

- Risk Management:

- In volatile markets, risk management becomes even more crucial. Setting appropriate stop-loss levels and position sizes is essential to protect against significant losses.

- Diversification:

- Diversifying your portfolio across different asset classes can help mitigate the impact of volatility on your overall investments.

- Adapting Strategies:

- Traders may need to adjust their trading strategies in response to higher volatility. Strategies that work well in stable markets may not be as effective in highly volatile conditions.

- Emotional Discipline:

- Volatile markets can evoke strong emotions, such as fear and greed. Maintaining emotional discipline and sticking to your trading plan is important.

- Stay Informed:

- Keeping up with current events and market news is crucial during periods of high volatility, as news can drive market sentiment and price movements.

Remember that volatility is a natural and inherent aspect of financial markets. While it can create both opportunities and risks, prudent risk management and a solid understanding of the market can help you navigate volatile conditions more effectively.

[contact-form][contact-field label=”Name” type=”name” required=”true” /][contact-field label=”Email” type=”email” required=”true” /][contact-field label=”Website” type=”url” /][contact-field label=”Message” type=”textarea” /][/contact-form]